Do you like saving money while keeping the same great coverage?

I would imagine most of you are much like me and enjoy saving money. Especially when those savings come from activities you are already doing on a daily basis and takes very little effort on your part. I also know how insurance advertising always focuses on saving you money, which in our professional opinion is that you always get what you pay for. So sacrificing coverage for a little savings may not come back to bite you now, but come claim time you may have some regrets.

This is where the driver Telematics many insurance companies have launched is great. Many of us feel we are good, if not great drivers in our own eyes. In the past insurance companies had no way to tell what kind of a driver you were other than lumping you in with others who had similar characteristics such as yourself (age, driving history, accidents, etc.) to determine your rates, but no way to see how you actually handled yourself on the road on a daily basis.

Per my prior blog post on December 6th, 2019 I felt our phones and smart devices do enough tracking of us already. The last thing I wanted was for someone to track my driving. After running the numbers on how much I would potentially save and coming to the realization that some time in the future most, if not all insurance companies will implement Telematics as a requirement to get their best rates I gave in and my wife and I signed up.

So now how do I feel after completing it and would I do it again?

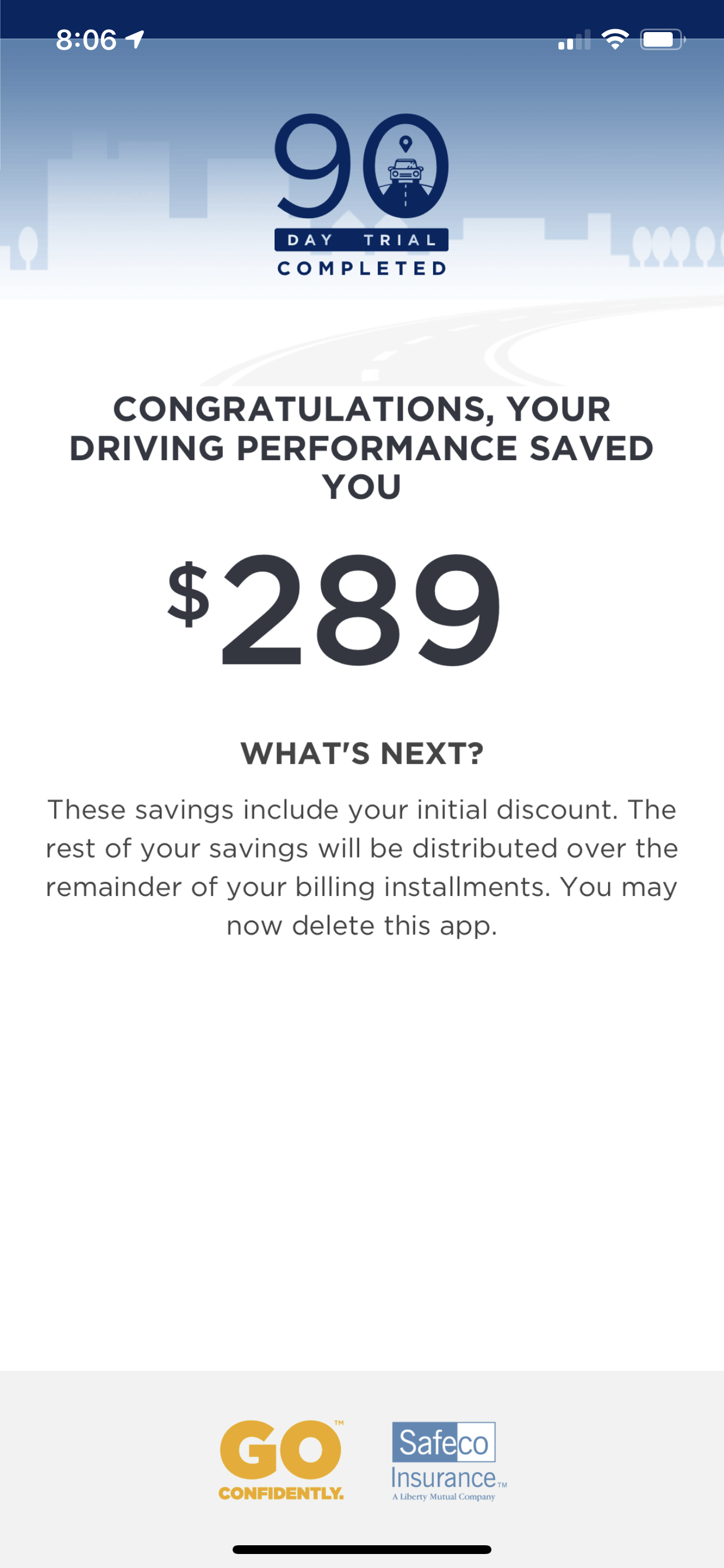

I feel great and as I suspected I am a pretty darn good driver and the results and savings prove that. With doing what I was already doing (not hard breaking, hard accelerating, or driving late at night) I saved $289.00 a year. Which is an 18% savings over what I was previously paying. So YES I would totally do it again in a heartbeat because I was already doing it (but without the tracking).

How do you find out more and what is the process?

Step one is to contact us today. From there we will confirm your current insurance company has a Telematics program, walk you through the process, and discuss if it is a good fit for you. If you work late hours and are driving between 2-5 AM for work it may not be a good fit for you, but it may be for other drivers in your household. Step 2 if you decide to proceed is to follow the instructions sent to you via email from the insurance company. This will include details on what app to download to your phone, who to contact for support, etc. Step 3 go out and drive like your normally would, if not better for the tracking period set by the insurance company. I'm insured with Safeco so I was tracked for 90 days.

Other FAQ's:

Q:How do I see how I'm doing?

A: Most apps will allow you to review your driving results real time and any of your other drivers in your household. Safeco's app rated me on a scale of "GREAT, GOOD, and OKAY". Typically since you are the one driving you should be aware of how you might score. For instance one day I was cut off and had no option other than to hard brake or rear end the car that cut me off. I went with the hard brake option and knew that my score was going to reflect it. So you will have some instances from time to time where your best driving option won't always provide you with the best score.

Q: What if I am riding in someone else's car? How does the app know?

A: Typically it does not know as it is only so smart. But in my case Safeco provides you with options when you review your driving results n the app. You can mark yourself as a passenger if you are a passenger. If you rode your motorcycle because the weather is nice you can indicate you were on your motorcycle and not driving the car you are being rated on. If you are in a taxi you can indicate taxi. So there are options and opportunities to check your data and make sure it is accurate.

If you feel you are a good driver and want to save on your insurance for simply doing what you are already doing contact us to discuss your options today.

Take care and be safe out there,

Ben